Q1 24 Performance Update

Dear Investors,

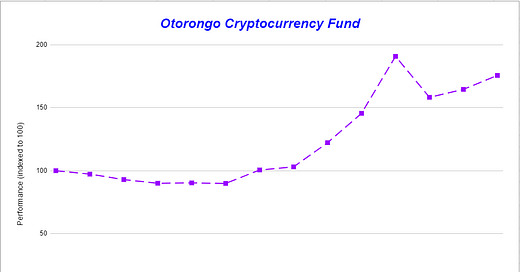

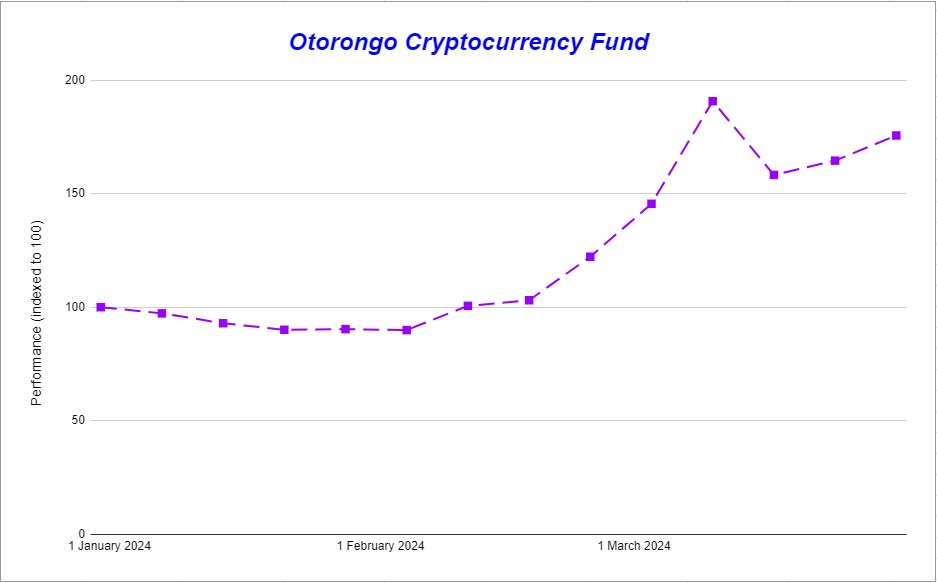

The Otorongo Cryptocurrency Fund returned 75.6% in the first quarter of 2024. This compares with Bitcoin’s gain of 68.7% in USD terms in Q1 2024.

Performance was dull in January given the lacklustre nature of the cryptocurrency markets especially post-ETF approval. Although we took a drawdown for a few weeks, we were defensive in positioning, holding mostly Bitcoin (BTC) throughout the month while waiting to get aggressive when market conditions are ripe.

In February, the overall state of the market improved. We noted the reset in investor sentiment and expectations, and BTC’s selloff post-ETF approval was excellent in flushing out the leveraged players who entered in January.

As noted in our post on 12 February, we turned aggressive and went long various types of projects including Layer 2s such as ImmutableX (IMX) and Optimism (OP). These trades did not play out as well as expected and we exited them after some time as per our exit rules.

In late-February, our models picked up the strong momentum in meme tokens and we noticed the sudden increase in speculation in new meme projects. Tokens were created out of the names of political leaders, actors, and lingo/slang, and this is a window for us into the current zeitgeist and social climate. Every cycle in the crypto world brings something new.

We decided to go long the incumbent meme-plays such as Shiba Inu (SHIB) and Dogecoin (DOGE), which contributed significantly to the portfolio’s overall performance in the first quarter.

While successfully catching these two meme token moves, we were also building positions in the Artificial Intelligence - Decentralised Physical Infrastructure (AI-DEPIN) space from late-February into March.

This is an exciting segment to participate given the global hype around Generative AI and how cryptocurrency projects may help the growth of the industry. Investor interest first piqued at with the Worldcoin (WLD) project that is founded by OpenAI chief executive Sam Altman, and backed by Andreessen Horowitz.

We spent the weekend of 18 February studying the AI-DEPIN crypto ecosystem and rebalanced the portfolio while waiting for our momentum models to pick up the plays that we will go long.

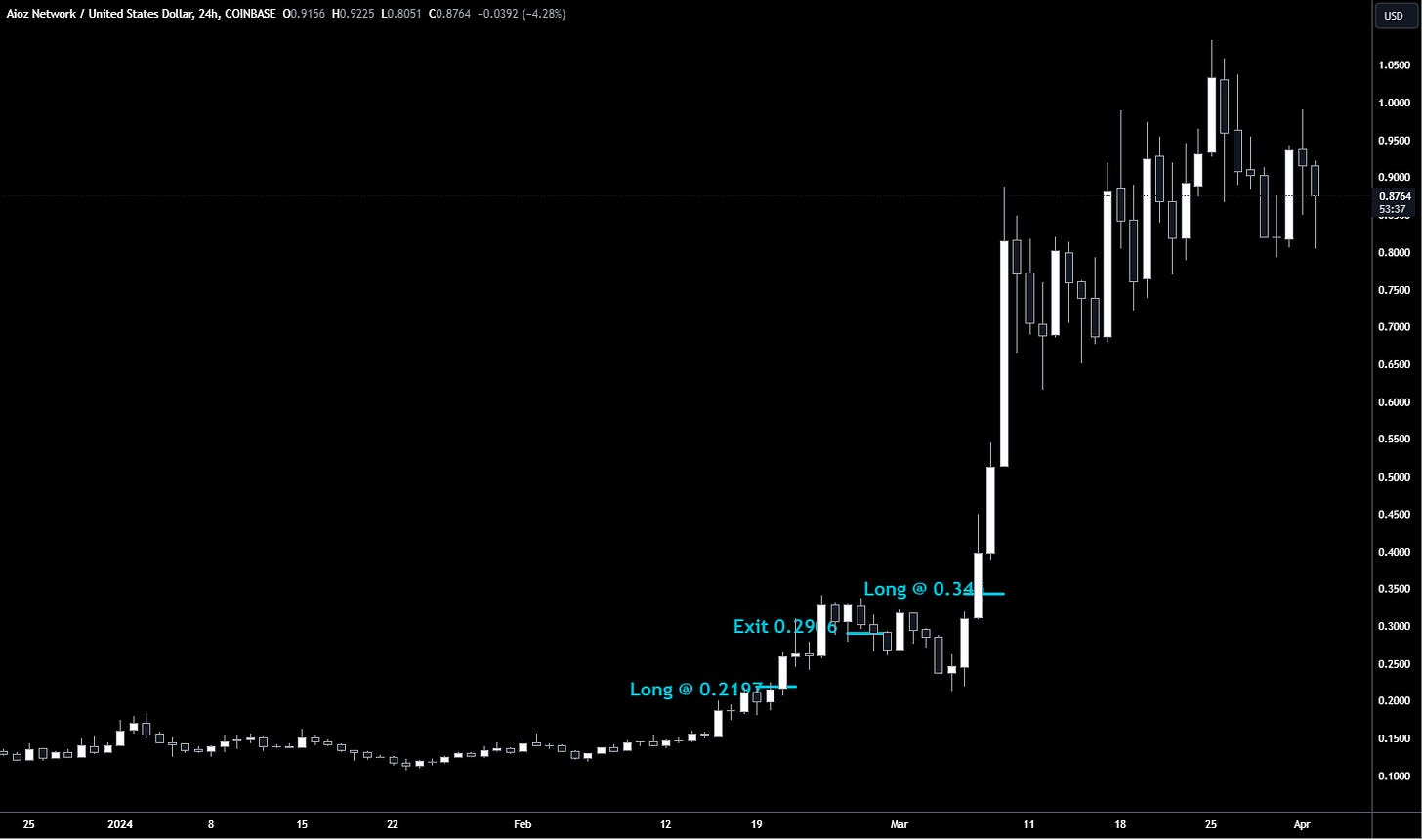

We went long storage project Filecoin (FIL), Render (RNDR), iExec RLC (RLC), Fetch.AI (FET) and Aioz (AIOZ) first on 20 February and later a series of rotational trades among FET, Orchid (OXT) and Ocean Protocol (OCEAN).

Our biggest winner from the AI-DEPIN campaign was AIOZ, which we fully exited on 29 March (we do not hesitate in getting back in if the time and system calls for it again).

Thoughts on March

March was a volatile month across the board and our performance volatility rose as well.

After BTC surged above the 70,000 level and made a new-high in mid-March, it sold off more than 17% and is still struggling around its current levels. The entire crypto space also experienced a sell-off and we rose USDC levels towards the end of the month in preparation of eventually trying to take advantage of lower prices.

We kept to spot positions and did not employ leverage at all throughout the quarter. That helped through the volatile periods as it gave us holding power and psychological patience as we watch leveraged positions being taken out multiple times.

However, what we did miss was the trade in the Real World Assets (RWA) narrative, which really took off in a short period of time in late-March. Propy (PRO), TruFi (TRU), Ondo Finance (ONDO), Goldfinch (GFI) rose between 50% to above 100% in just a matter of five days into the quarter’s end.

Going Forward

We’ll be providing high level thoughts on BTC very soon, and we do not expect the current weakness in the markets to last long. Thank you for reading and your trust in us in managing capital in this exciting space of digital assets.

As usual, the Otorongo watches and readies to pounce.