There is nothing as powerful as rapid change when different variables and the necessary background conditions align.

It’s difficult to grasp this concept, but we can learn this by observing our natural world. In the field of Thermodynamics, a critical point is known as the ‘end point of a phase equilibrium curve’.

In English, this simply means a point of drastic and inevitable change.

Think of how liquids transform into gaseous states. There is a slow and gradual build up of necessary conditions and gradual but unobservable changes in a liquid before it suddenly transforms into a gaseous state at a critical point. This concept is illustrated in the chart below:

French physicist and engineer Charles Cagniard de la Tour first made this observation when he was conducting gun barrel experiments that were filled with fluids at various temperatures. He found that for each liquid, there was a certain temperature which it refused to remain at a liquid state (passed into gaseous form). This is despite of whatever amount of pressure it was subjected to.

At the critical point and subsequent transformation, the properties of the observed matter change dramatically. When H2O is in its liquid state, it is nearly incompressible, has a low thermal expansion coefficient, and an excellent solvent for electrolytes. However, when it nears the critical point, H2O becomes compressible, expandable and a bad solvent for electrolytes.

The understanding of critical points permeates the world around us, and in complex adaptive systems like the financial markets, we can also identify critical points in the characteristics of various asset classes, and capitalise on their expected price changes and behaviour.

Bitcoin entering Phase Transition

Once a speculative asset ridiculed by the traditional finance industry, Bitcoin (BTC) is now increasingly viewed as a legitimate asset that serves some kind of function within an investor’s portfolio.

BTC exploded into mainstream consciousness in 2017, and became the talk of the town during the Covid Pandemic and days of lockdown as speculative fervour heated up. The collapse of the cryptocurrency market in 2022 wiped clean almost all of the new found interest in this asset class.

But progress has been made since then. Price recovery since late-2023 has revived interest, and the approval of spot BTC exchange-traded funds (ETFs) has allowed more participation from both Wall Street and Main Street. This means that buyers don’t have to go through the whole process of setting up digital infrastructure (wallets, custody, etc.) to own BTC.

Institutional investors such as pension funds and endowments seeking static, long-term allocations to BTC can now use ETFs to fulfill their mandates. These participants are slower than the traditional participants in cryptocurrencies historically but have a ton of firepower.

Additionally, many employees at big Wall Street banks face less restrictions in holding cryptocurrencies as compared to traditional instruments such as equity and fixed income securities.

Taken together, this situation changes the dynamics on the buyer’s end, and allows more capital to come into BTC and cryptocurrencies as a whole. This changes BTC’s characteristics.

While comparisons and analogs have been made to Gold ETFs, we are likely to see BTC behave more like an equity index such as the Nasdaq. The days of crazy volatility such as its early days (2013-2018) may be a thing of the past. Dips are likely to be bought in a bullish technical regime, with more and more transactions executed algorithmically.

Older generations are also increasingly interested in the digital asset, raising the amount of potential demand and buying pressure. In Singapore, the baby boomer generation is warming up to BTC:

Crypto adoption among Generation Z, or those aged 18 to 25, has grown to 47 per cent in 2024 from 38 per cent in 2021. The take-up by boomers – those aged over 55 – has risen to 30 per cent from 19 per cent in the same period…

Boomers, in particular, are very bullish about crypto. A quarter of them said they will hold or increase their crypto allocations despite cost-of-living pressures. The survey said boomers’ financial stability and reduced financial obligations are possible reasons for this.

Taking a step back and looking at the background conditions, we see a very favourable macro landscape for BTC and cryptocurrencies as a whole.

The US Federal Reserve has communicated its intent of lowering policy rates, which typically is a boon for risk assets. Cryptocurrencies, being at the furthest end of the risk spectrum, are likely to benefit from this backdrop of lower interest rates and robust economic growth.

Positive Technicals, Favourable Seasonality

Since we explained our bullish stance back in February, a fire has been set below crypto markets, and they have certainly blasted into headlines globally. At that time, Bitcoin (BTC) was at 48,000 and now it’s hovering around 70,000, surpassing its previous high of 69,000 recorded back in November 2021.

It has pulled back more than 17% since making a new high, and has rebounded back to the 70,000 level once more. It’s likely to have completed a healthy retracement (flushing out some leveraged speculators who bought at the new high), and is currently on the cusp of a breakout to the upside.

This has played out similarly in previous bull cycles. In March 2017, BTC sold off approximately 34% after surpassing it’s previous 2014 high before rebounding and surging off into a crazy summer:

And in October 2020, BTC fell around 17% after touching above 19,000 before resuming its upward ascent:

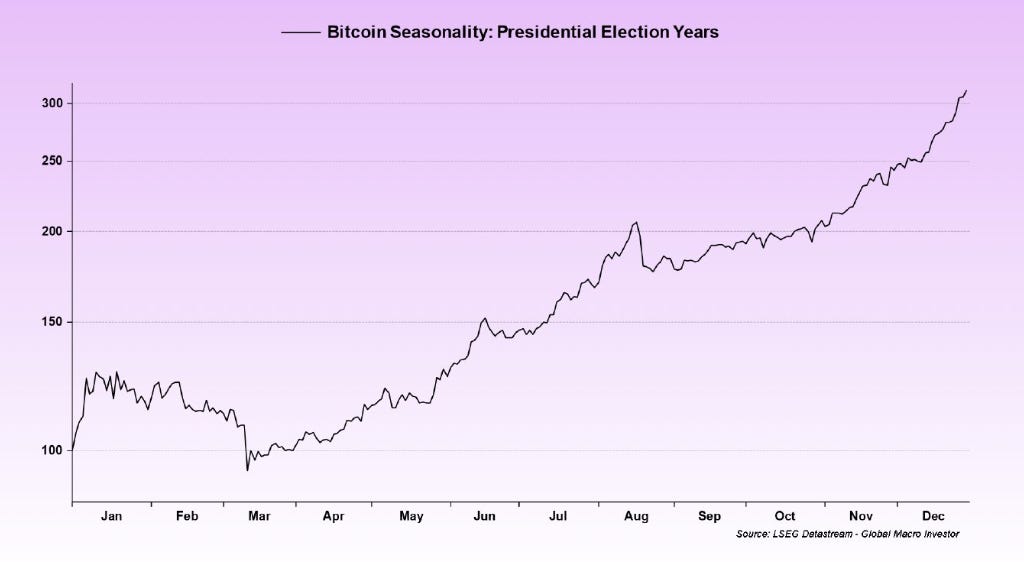

We note that yearly seasonality is also favourable, whereby BTC and crypto markets have tended to do well during election years in the US.

The Otorongo is positioned and watching…